A survey of 2,000 bank clients in Singapore and Hong Kong finds that almost half of them would use AI-powered investment tools if they were offered. However, customers in the two cities are divided in how they most want to use AI.

The findings come from US-listed financial technology business FIS®, and shared exclusively with this news service. Some 46 per cent of Hong Kong bank customers and 51 per cent of their peers in Singapore revealed an appetite for such tools.

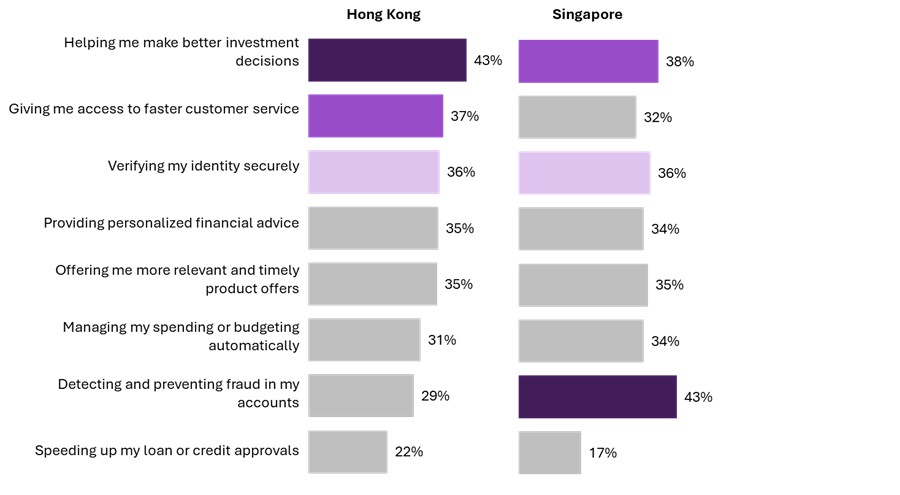

In Hong Kong, 43 per cent of consumers ranked AI's ability to make better investment decisions as its most important application, ahead of fraud prevention or secure identity verification. Singapore consumers, by contrast, put security first: 43 per cent identify fraud detection and prevention as AI's most critical role, with the ability to improve investment decisions coming in second.

The findings, while from a broader population sample than those in the private banking area, highlight why firms make large efforts to discern the most lucrative use cases for AI. The rise of generative AI and other tools has been one of the most salient stories of the past few years, affecting many elements of the wealth management value chain. (See articles here and here, for example.)

Consumers in both markets show limited enthusiasm for AI's potential to speed up loan and credit approvals, which ranked as the least impactful use case by 22 per cent of Hong Kong respondents and 17 per cent in Singapore.

Ranking the areas where artificial intelligence will drive the most impact in banking over the next 12 months

The enthusiasm for AI, however, comes with important caveats. Among those who say they are unlikely to use AI investment tools, concerns centre on data security, trust, and the desire for human judgment in financial decisions. In Hong Kong, 38 per cent cite fraud and data security worries, while 36 per cent say they simply don't trust AI. In Singapore, the top concerns include the potential for inaccurate or biased advice (40 per cent), risks related to fraud and data security (40 per cent), a preference for human judgment (40 per cent).

"Consumers in both markets are connecting AI directly to better financial outcomes. They understand it can deliver sophisticated analysis and personalised guidance that helps them make smarter money decisions," Amit Chopra, head of banking and payments for FIS, said. "However, for banks investing heavily in AI infrastructure, deployment must be thoughtful, transparent, and responsive to customer concerns.”

FIS’ survey was conducted by Kantar in September 2025. The data is based on a representative sample of 1,000 banking customers each in Singapore and Hong Kong.